By Ajka Kudic, Case Manager | kudic@precisionlienresolution.com

Not all healthcare plans in personal injury cases are entitled to assert a lien against personal injury proceeds. However, if you have a self-funded ERISA healthcare plan, you may be required to reimburse your employer or health insurer from the proceeds of your personal injury settlement. In a self-funded ERISA plan, the employer directly covers your medical costs, leaving plaintiffs and their families responsible for reimbursing the employer for medical expenses. For ERISA-qualified plans, which make up about half of all health insurance plans nationally, health insurers or employers may impose what is often referred to as an “ERISA lien” on personal injury settlement proceeds to seek reimbursement. ERISA liens can impact personal injury cases while posing unique barriers to lien resolution.

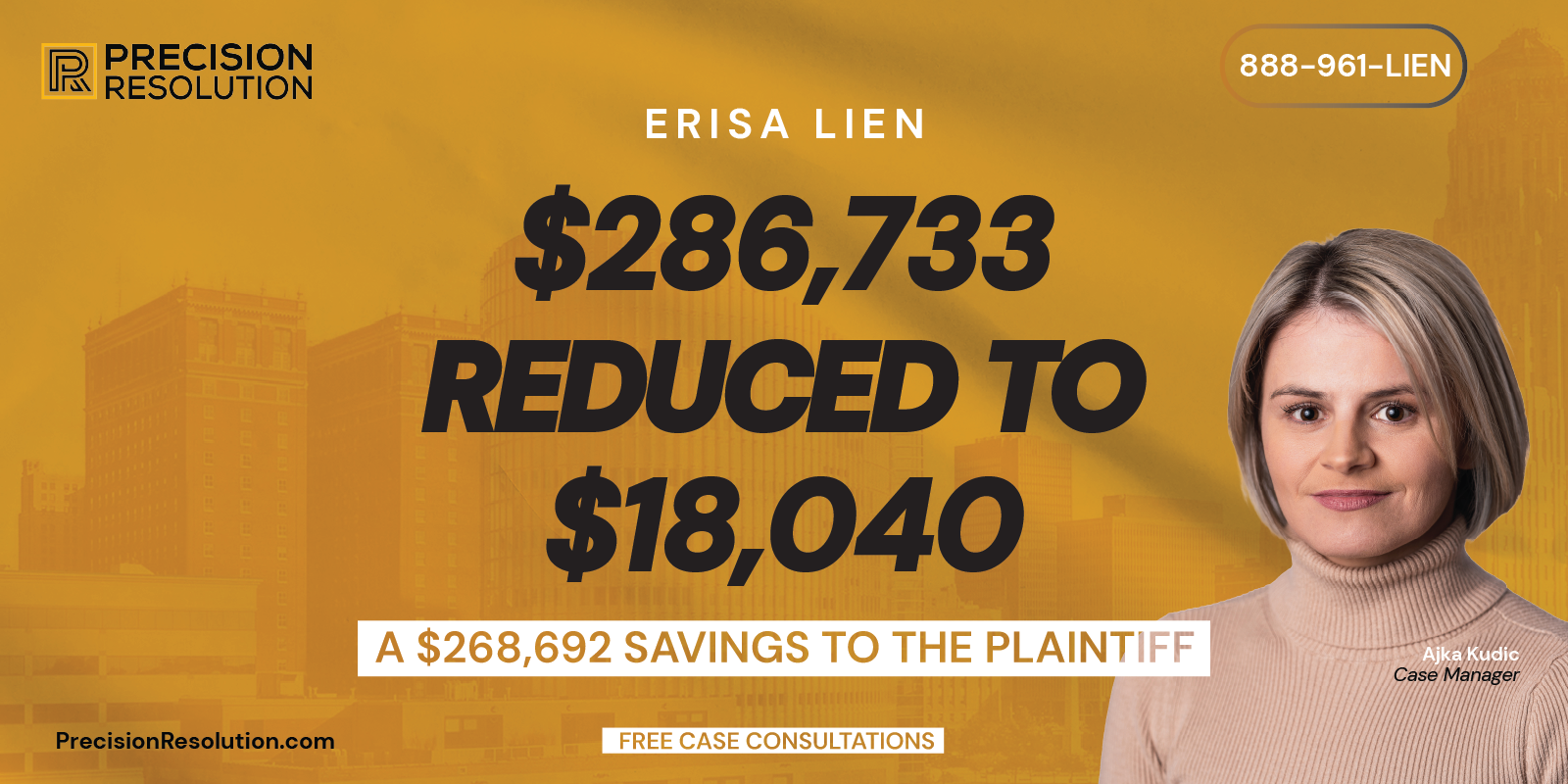

Continue reading for a real-world example of how the author of this article, Precision Resolution Case Manager Ajka, successfully lowered a plaintiff’s ERISA lien while working on behalf of their personal injury attorney by more than 85%.

What is an ERISA lien?

ERISA liens come into play when an individual is harmed as a result of another person’s negligence, and their subsequent medical expenses are paid by their or a partner’s employer, through the insurance offered by the employer. In scenarios like these, if victims decide to sue for personal injury or wrongful death, the employer may have a right to pursue reimbursement for past medical expenses paid related to personal injury action. Depending on plan details and the plan’s supporting documents, the employer may be entitled to a dollar-for-dollar reimbursement of these costs.

ERISA Liens and Personal Injury Settlements

Lien recovery contractors seeking repayment against plaintiffs on behalf of ERISA plans, rely on nuanced legalities to claim they are under no obligation to reduce lien claims, regardless of the situation. This does not bode well for injury victims, who may be subject to a personal injury settlement lien, obligating them to allocate a portion of settlement funds to reimburse their employer or health plan. Reducing ERISA liens depends greatly on the health plan’s fine print and whether it is self-funded.

ERISA Lien Resolution Case Example

Lien resolution can be a lengthy process rife with financial, legal, and bureaucratic complexities, involving coordination and communication with multiple parties whose interests can conflict with the plaintiff’s. Disputing a lien can strain the plaintiff’s legal representation, who is already engaged with defense counsel in the primary case and third-party agencies hired by the plaintiff’s insurance plan to pursue an ERISA lien. Attorneys can outsource lien reporting, tracking, and negotiation by hiring a firm like Precision Resolution, which specializes in a variety of liens, including ERISA liens. Precision Resolution Case Manager Ajka was recently involved in a particularly challenging case, working on behalf of a wrongful death victim whose family had filed suit against the negligent medical practitioner.

Overview

Ajka successfully reduced the plaintiff’s ERISA lien by over 85%, rigorously refuting the medical expenses tabulated in the initial lien calculation. The journey to resolution spanned six months of persistent negotiation and advocacy, relying on evidence within the patient’s medical records and a deep knowledge of the healthcare system to navigate a favorable outcome for plaintiffs.

The case in question centered on a dispute over the cost care received during a routine procedure turned tragic: a failure to diagnose a post-operative wound hematoma that led to cardiac and respiratory arrest, culminating in a serious hypoxic brain injury. The initial lien incorrectly attributed medical care provided on an earlier date to treatment received in the events leading up to and including the hypoxic episode.

Initially, the lien holder asserted a claim of $286,733.42. This amount included charges for medical care Ajka identified as unrelated to the malpractice incident. It’s not uncommon for employers and insurance companies seeking reimbursement using an ERISA lien to include costs outside the scope of treatment for the primary injury.

Case Outcome

In this case, expenses related to a family member’s separate elective spinal surgery occurring just prior to the harmful second surgery, were included in the lien. By reducing the ERISA lien to $18,040.93, Case Manager Ajka helped the deceased plaintiff’s family retain more of the financial relief they received as compensation for their loved one’s wrongful death.

Contact Precision Resolution

Precision Resolution offers premier outsourced lien resolution services for attorneys aiming to enhance client services, achieve optimal case outcomes, and maximize settlements for plaintiffs. With over $200 million reduced in single-event cases, Precision Resolution’s commitment to ensuring fair treatment for plaintiffs and our experience in delivering fast, favorable results are unmatched within the lien resolution industry. Contact us to learn why Plaintiffs appreciate the human touch and high level of accountability we bring to a lien resolution experience that for far too many plaintiffs, is focused only on the numbers.